-

Subscribe and receive monthly news about BT Asset Management investment funds.

-

You can unsubscribe whenever you want, find out how here.

How do you choose your investment fund?

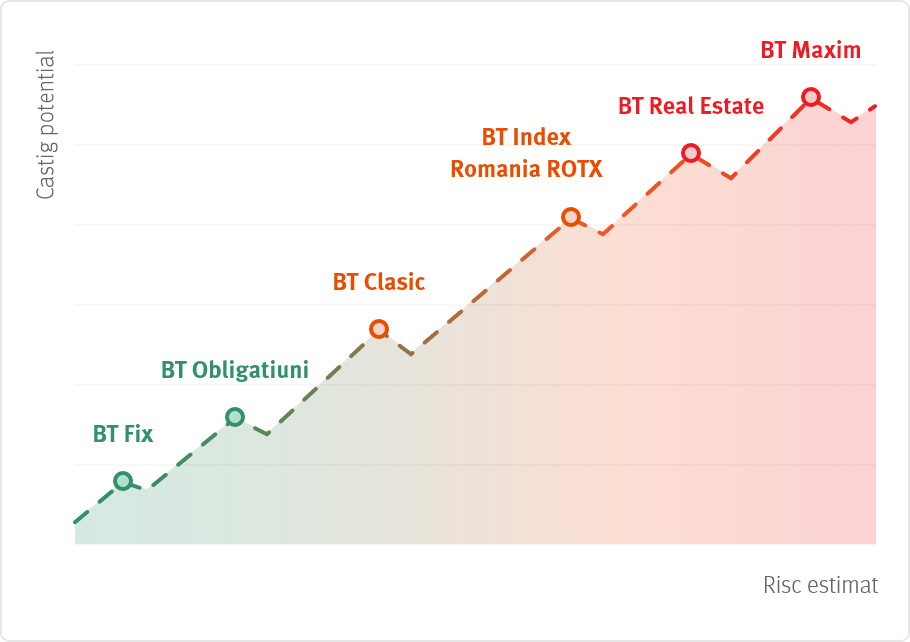

We offer clients the possibility to choose between 17 investment funds, with very different degrees of risk and potential returns - from bond or fixed income funds, to funds investing in Romanian, European Union or third country equities, including thematic funds (agro, energy, real estate, technology). In LEI, EURO or USD.

Access to funds is available to customers through the BT branch network, and after joining and/or first purchase, online through BT24 and NeoBT applications - the investment process is much more simplified

You can find out which funds suit you by completing a short questionnaire. This is designed to help you establish your risk profile and can be accessed here.

Alternatively, you can search for the desired background by applying the filters below.

I want details

If you would like to buy fund units or need more information, fill in the form below and we will get in touch with you.